Are you moving to Singapore or realising that your current stay is exceeding the time you planned? Then it might be time to consider international health insurance for you and your family. If the COVID-19 pandemic has taught us anything, it's that our health is much more vulnerable than we once thought.

As lockdowns and travel restrictions persist, expat families in Singapore may find it too difficult to return home for routine medical services or emergency care. If your company doesn't offer healthcare or it only provides basic medical coverage in Singapore, it might be time to consider a more comprehensive international health insurance plan to expand your benefits. Here are 4 reasons why expat families in Singapore should consider getting international health insurance sooner than later.

Your Employer's Health Insurance May Not Cover Your Family

Between your home country's health insurance and your employer's insurance plan, you may be covered for basic medical expenses, but this does not necessarily apply to your family. In some cases of employer group health insurance, you'll find that your children and spouse are either partially or not at all covered by your plan. Some employer group plans give you the option to add on additional insurance for your dependents, but this is not certain for every provider.

If you find that your employer's health insurance does not adequately cover your dependents, then subscribing to an international health insurance plan will do wonders for the protection of your family. With an international health insurance plan from providers like FWD, you can feel confident knowing that up to 4 dependents are eligible for quality healthcare without the burden of high out-of-pocket costs or high premiums. For instance, a family of 3 would only need to pay S$462 per month for S$500k sum assured of inpatient and outpatient coverage.

International Health Insurance Expands Your Medical Coverage

Even if your employer covers your spouse and children in their group health insurance, it's important to note that their coverage may not be as extensive as an international health insurance plan. Similarly, it's entirely possible that your employer does not offer any kind of health insurance in your contract, in which case it is well advised that you invest in an international health insurance plan so that you are covered in case of an illness or accident. No matter the case, the lack of benefits could harm you and your family in the long run. For instance, you may find that your employer's health plan does not include coverage for:

- Critical illness

- Dental care

- Vision Care

- Maternity Care

Due to travel restrictions, you may be unable to regularly return to your home country for routine vision and dental maintenance. And while you may not be planning for a need of maternity and critical illness coverage, there could come a day when you require financial protection due to unexpected circumstances. For instance, without maternity coverage, you could end up paying an out-of-pocket S$6,398 for 9 months of prenatal care, alone.

On the other hand, an international health plan offers maternity, dental and vision add-ons to the basic hospitalisation coverage that is tailored to the expenses you'll need to pay in Singapore. Furthermore, with a more comprehensive IH plan, you'll have access to private health care practices and specialists with shorter wait times than at public healthcare institutions. In addition to these benefits, plans like FWD International Health Insurance uniquely offer a No Claim Bonus option, where you can double your annual limit if you do not make hospitalisation claims for 2 years, effectively rewarding you for the years that you stay healthy.

You're Covered No Matter Where You Go

While COVID-19 lockdowns are still a reality, there will come a time when you are able to travel for business or pleasure. When this happens, you'll want to be protected by an international health insurance plan that covers you no matter where you go. Depending on your IH insurance plan, you can make medical claims for expenses incurred outside of Singapore. Additionally, every IH insurance provider has their own global network of medical facilities, which will come in handy if you require immediate health services whilst on a business trip or vacation.

Some expats invest in travel insurance, which is designed for short-term trips abroad, like a one-week vacation. However, while many travel insurance plans cover emergency medical treatment, the aim is not to cover long-term medical expenses. Therefore, if you're an expat who's settled in Singapore with your family, but still need to take longer business trips, then an annually-renewable IH insurance plan is your best option for medical coverage.

In addition to global coverage, some international health insurance plans provide you with medical evacuation and repatriation options. Meaning, if you fall ill or injured with a life-threatening medical condition outside of your country of residence, then your IH plan will cover expenses to transport you to a medical facility (overseas or upon return to your country of residence). If you foresee travel in your future, then an international health insurance plan is key to protecting you from the confusion of navigating healthcare in a foreign country, as well as potentially high costs of going to foreign health clinics without local insurance.

Save Money Later By Investing In An International Health Insurance Plan Now

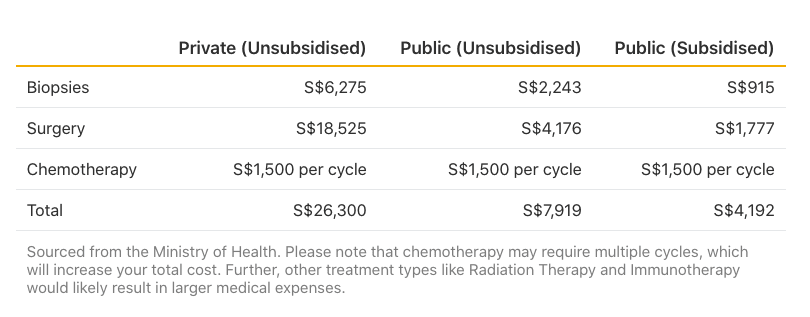

Even if some outpatient services in Singapore are affordable for you, unexpected illnesses and accidents could drive up your medical expenses to the thousands. To protect yourself and your family from the reality of medical debt, an international health insurance plan is necessary. To see just how much you could save in the long run with an IH plan, take a look at the average hospital bill for breast cancer treatment.

Average Hospital Bill For Breast Cancer Treatment

Since non-resident expats do not have access to subsidised healthcare in Singapore, an expat could end up paying a minimum of S$7,919 in out-of-pocket expenses for a single round of biopsies, surgery, and chemo at a public hospital. If you are seeking care at a private hospital, you can expect to pay 6x more than you would at a public hospital, or roughly S$26,300. Because cancer requires many months of treatment, these costs can add up quickly and become debilitating to your financial health.

However, international health insurance usually pays for cancer treatment in full. This is in contrast to your employer's insurance, which may cover cancer treatment, but is likely capped at a maximum annual benefit (i.e. S$20,000 per policy year). Furthermore, in the case that you are in need of a specialist, critical illness coverage, or pre and post hospitalisation treatment, international health insurance can save you from taking out an exorbitant amount of money from your savings accounts. Thus, in the unfortunate case that you are diagnosed with a long-term illness, you can feel confident in going to the doctor without leaving with a hefty bill.

How Do I Get International Health Insurance?

As we learned from the coronavirus pandemic, some health issues do not call before coming. This is why it's important to invest in a comprehensive international health insurance plan so that you and your family are covered on all bases.

If you're interested in getting an international health insurance plan, you can choose from global and local health insurance providers. Expats may benefit most from a local insurer, as it's more convenient to make claims and receive payments. It's important to do your research and understand your family's medical needs before applying for an IH insurance plan. If you're worried about costs, then you can feel well knowing that insurers in Singapore may fit right within your budget, for instance FWD International Health Insurance is among the most affordable plans in Singapore.